Back in the “good old days,” there was no internet and the number of TV channels that you could watch was limited. Brands could be easily seen and heard with smart messaging and a strong media plan. However, the invention of the internet and widespread technology has changed the way people consume media and purchase products.

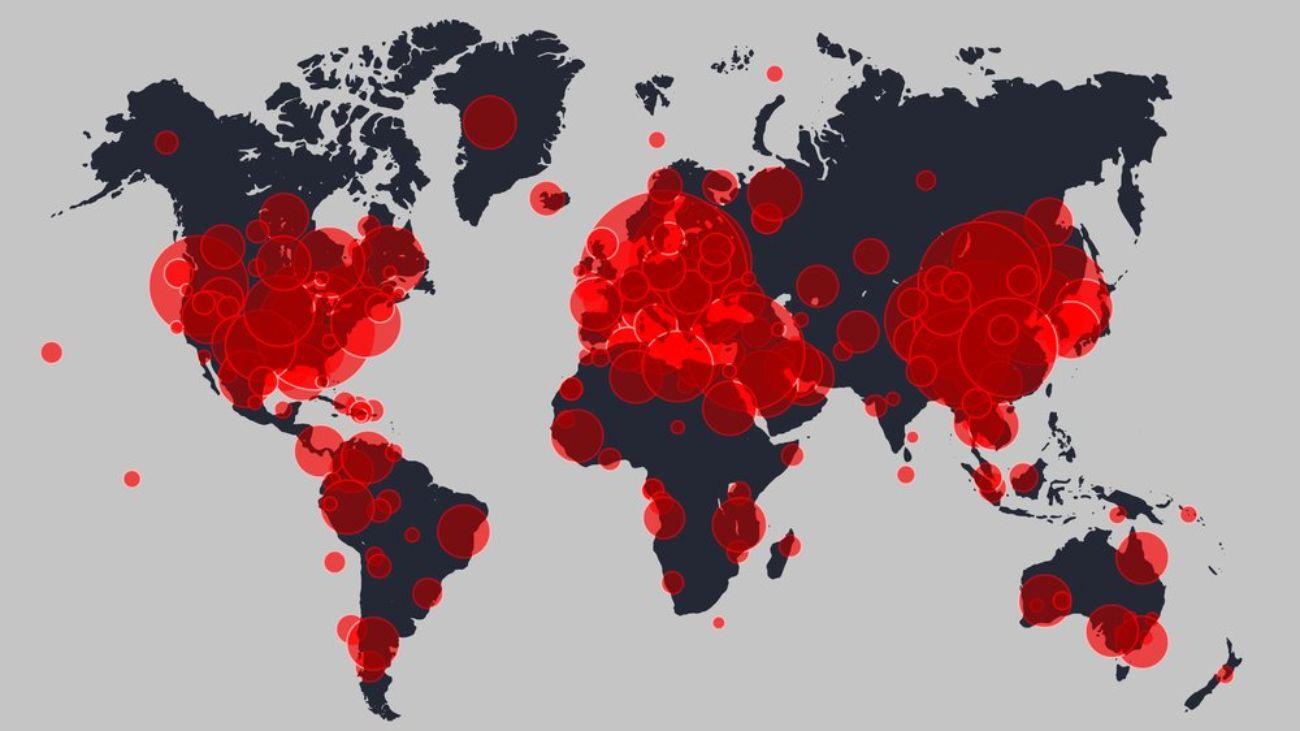

The COVID-19 pandemic has massively accelerated the rate of technology adoption. Americans are relying on working and shopping from home. As a result, people are using technology more than ever and the usage of work software has skyrocketed.

As a result of this increased online usage and technology adoption, consumers’ media consumption has evolved further. This behaviour modification impacts how advertising drives brand equity. Brands now must have a strong online presence throughout every stage of the consumer purchase journey.

Brands must analyze the current purchase journey of the service or product to make sure that it reflects this high online media consumption. It is no longer a simple task to understand what drives awareness, conversion and, ultimately, loyalty. Brands need to determine if they reflect their consumers’ digital behaviours as well as any offline tendencies that have remained or may reemerge post-pandemic. Therefore, the consumer journey needs to be reevaluated and brands need to understand consumers’ use of online shopping/e-commerce and in-store shopping, etc.

So, how can market research capture these changes? How can research determine market potential, the optimal marketing mix and the success of current advertising initiatives? Are there any behaviours that customers are currently doing that are not known by the brand? Has a new audience emerged due to the pandemic?

There are no one-size-fits-all solutions to consumers’ changing behaviours. Every brand has its unique target audience, path-to-purchase and attributes unique to its brand and industry. Therefore, a template survey or guide may not work in this ever-changing world. This article will map out how to evaluate behaviour change and what that means for a company’s advertising and media strategy.

Assess any differences

Has the brand previously mapped out the consumer journey? If not, a brand should do so and assess any differences between its competitors. If the brand already has a strategy in place, it is critical that the strategy is reevaluated in 2021. While “how” consumers interact during the purchase process has most likely changed since March 2020, the actual steps to driving conversion remain the same. The steps often follow the outline below:

- Need: When does the need arise? How does the market differ as compared to before the pandemic? Where do consumers look to solve the need (channels, word of mouth, etc.)?

- Awareness: Which brands are they aware of? What are the benefits of the brands? What is unique? What is the same? How did they learn about these brands? How has perception changed since pre-pandemic?

- Consideration: What brands are in their evoke set? How do they compare the different options? What are the criteria needed to help make the decisions? How has the decision-making process changed in the last year?

- Purchase: Where/how did they ultimately purchase the product? Has purchasing in-store vs. online changed? What are the barriers to purchasing or switching? Is in-store behavior expected to go back to normal levels post-pandemic? Is there a setup/integration process?

- Loyalty: What helps drive repeat purchases? Referrals? Is it hard to switch brands? How is price-sensitivity a factor in driving loyalty?

For each of these stages of the consumer journey, it is essential to determine what online and offline channels are being used (e.g., in-store advertising, organic search, reviews, sales reps). What is the relationship between online and offline behaviour? For example, a person may learn about brands in-store and then go online to a comparison-price website to find the cheapest price. Another scenario could involve a consumer becoming aware of a product via TV or Instagram but then using online reviews to determine if the product is up to par.

Mapping out the journey for both the brand and its competition can determine the following at each stage: advertising key message; advertising tone and look; call-to-action; online and offline media channels to use; expected and missed sales per retail channel (online and offline); and what KPIs (metrics) are needed to evaluate success.

In this new era, the information will show advertisers and media buyers where to focus their energy; it can cause a redistribution of messaging, the creative and even the media plan.

When evaluating each stage of the new consumer journey, it is crucial to determine if there are gaps in this plan; this includes areas with no data to back up a rationale. If this is the case, research is needed to help fill in the blanks. Below are five ways to create an up-to-date and actionable consumer purchase journey:

1. Easily available internal data. The first step is to see what information the company already has. From sales revenue data to Google and Facebook Analytics, most brands already have access to insights that can tell them a lot. This type of information helps provide clues on prospects and customers, including where they shop and analytics on the company’s assets (e.g., website, social media sites, in-store data). Most importantly, it is vital to compare current data to historical information to see if media habits have changed during the pandemic.

For example, by simply reviewing Google Analytics a brand can learn:

- Is there an uptick in web traffic?

- Which types of devices are consumers using to visit the site?

- What location (geography) are prospects visiting from?

- What is the source of website traffic (e.g., paid search, article, e-mail)?

- What actions do they take on the website (e.g., purchase product, fill out a contact form)?

2. Readily available external data on competitors and industry trends. A brand’s competitive landscape is continually evolving, especially since the beginning of the pandemic. Staying on top of what the competition is doing helps a brand determine where the brand’s journey is strong or weak. Ultimately, this information creates a more robust advertising and media plan.

There are several free and low-cost options available that can help inform the competitor’s consumer journey. This information can identify white-space market opportunities. Given how the pandemic has changed consumption, it is vital to look beyond the direct competitors to stay ahead of the curve by also tracking the indirect competitors.

Freemium tools such as SimilarWeb, Semrush, Moat, iSpot.tv and Follow.net can deliver a wealth of data about competitors’ online behaviour at a low cost. The tools provide competitors’ web traffic and online advertising as well as online ad spend. More expensive options such as Numerator and Kantar Advertising Monitor offer both offline and online analysis.

Furthermore, several companies (including research companies) have published thought leadership research on behaviour change during the pandemic. This information may be useful in understanding overall industry trends.

3. What does the new consumer landscape look like? By surveying a representative population of purchasers of the industry’s product or service, a brand can determine how the demographics and psychographics of its and the competitors’ customers have changed and if a new audience has emerged. The pandemic has not only changed media habits but also uprooted habits and routines. The impact of these shifting behaviours has also created potential new audiences for brands.

Understanding how consumers have changed purchasing and media habits allow for a brand to target its customers and prospects better. The research can also reevaluate messaging and media habits to determine changes.

4. Speaking to customers, competitor customers and new-to-the-industry prospects. To better understand how consumer media habits have changed in the last year, qualitative research allows a brand to understand better what it is like to walk in your consumers’ shoes. Also, qualitative research helps uncover core drivers impacting brand perception and whether these views have changed. The company may also want to speak to industry experts to gain an additional perspective.

5. Putting everything together. Evaluating the consumer journey using multiple research methodologies is helpful. However, putting together the extensive analysis into one document is not an easy task. Reviewing and analyzing the data in a brainstorming session with leadership, advertising and media agencies provides multiple perspectives on putting the journey together in an actionable manner. It is helpful to have a moderator in these sessions to ensure the session is as practical and actionable as possible.

Furthermore, the sessions can help secure buy-in from leadership and the decision-makers if the current advertising and media need to change due to the acceleration of online media habits.

With an updated consumer journey, brands will have the much-needed direction on how to adjust media and advertising initiatives as well as to measure each aspect’s success. As technology adoption continuously increases and behaviours will change post-pandemic, it is crucial to add and modify the pathway.

Author: Carly Fink

Editor’s note: Carly Fink is president, head of research and strategy at research firm Provoke Insights.